Content

Scientific article

Bitcoin vs. sovereign money : on the lure and limits of monetary reforms

Paul, Axel T.

Abstract:

Although indispensable and in daily use, money and more specifically money creation in our two-layered fractional reserve banking system is still poorly recognized by social science at large. Its main features are outlined in order to identify (a) money’s double nature to be private and public at once and (b) inflation and speculative excess as two of its inherent dangers. Bitcoin and sovereign money are discussed as prominent examples of, on the one hand, private or libertarian and, on the other hand state-oriented or social-democratic monetary reforms, each intended to solve one of the two systemic problems our currency order. The new money’s respective advantages notwithstanding, it is shown that neither Bitcoin nor sovereign money can overcome money’s double nature or realize the dream of an eventually neutral money.

Pages: 8-21

Scientific article

Between “market” and “reciprocity” : how businesses use local currencies

Degens, Philipp

Abstract:

This paper explores the relation of money, market exchange, and reciprocity, specifically by investigating how businesses use local currencies. Local currency (Transition currency, Regiogeld) is a particular form of alternative monies that circulates in parallel to and backed by legal tender within a restricted local space. It is argued that, notwithstanding the economic objectives of such schemes and their proximity to the formal economy, local currencies can be understood as means of payments for particular, convivial purposes that are based on reciprocity and commensality. The analysis is based on Karl Polanyi’s distinction between all-purpose and special purpose money and his identification of different modes of exchange. Viviana Zelizer’s notion of earmarking is then applied to local currency schemes in order to assess how and for what purposes businesses and traders that accept local currencies actually use it.

Pages: 22-36

Scientific article

Temporal markets : money, the future and political action

Esposito, Elena

Abstract:

Following Keynes and Shackle, money can be defined by its temporal nature, as a tool for managing and using the uncertainty of the future – as a problem and as an opportunity. Finance, which relies on money, can be described as a large apparatus that relates to the future while operating in the present, or the present intervention in the construction and structuring of the future. The financial crisis, in this context, can be brought into connection with an inadequate management of the future in terms of risks and its actual conceptualization. The reference to time also allows one to interpret the approach and the effectiveness of public policies on finance This paper examines the measures of Quantitative Easing, describing it as “injection” of time into markets, in the hope of encouraging the use and construction of the future.

Pages: 37-45

Scientific article

Households at the frontiers of monetary development

Bryan, Dick; Rafferty, Mike; Tinel, Bruno

Abstract:

The Global Financial Crisis and its aftermath has been an extraordinary period of innovation in monetary policy. There has been a dramatic expansion in the scale and scope of monetary intervention (quantitative and qualitative easing (QE and QQE). Moreover, this intervention has evolved so as to target finance itself through central banks coming to operate as ‘liquidity providers of last resort’ and producers of so-called ‘safe assets’ for investors. Policy innovation continues to run ahead of theory, and finance and monetary theorists are still absorbing and debating the implications of these policy innovations. Underlying the new debates about the impacts of particular policies there remains the more abstract question of how money and finance is anchored in the material world and how that anchoring supposedly connects to notions of ‘stability’. This paper suggests that, beyond the technical policy innovations like QE, one such anchor for monetary stability is being actively sought in an unlikely economic and financial unit – the working class household; specifically in the securitisation of regular household payments. At the core of securitisation is a process of risk shifting to households, and it is the capacity of households to absorb new financial risks that enables both these securities backed by household payments to circulate as ‘safe’ assets, and for this safety to give finance a material anchoring in social relations. The story of monetary development is then about finding and securing a new class dimension to the issue of financial stability.

Pages: 46-58

Scientific article

Card crusaders, cash infidels and the holy grails of digital financial inclusion

Mader, Philip

Abstract:

This paper analyses the turn toward financial inclusion in general, and toward digital money and the end of cash in particular, in development policy. It examines the profit-oriented logics at work and raises critical questions about the moral crusade being waged over digitalising poor people’s money. It begins with a discussion of why financial inclusion has displaced microfinance on global development agendas, and is bringing new practices and players to the space of poverty finance. It shows how financial inclusion modifies the theory of change underlying poverty finance, with financial intermediation rather than income generation now being seen as crucial to poverty alleviation, and analyses and explains the particular emphasis on promoting cashless payment systems. As becomes evident, powerful actor coalitions (card crusaders) are assembling to push for an end of cash and the full digitalisation of poor people’s money. These crusaders pursue three holy grails: to capitalise on everyday transaction costs, to use big data generated by the poor for sale and analysis, and to exert greater governmental over poor people’s money. This raises serious questions about the possibility of empowerment through financial inclusion.

Pages: 59-81

Scientific article

Re-risking in realtime : on possible futures for finance after the blockchain

Maurer, Bill

Abstract:

Contemporary financial technology (“fintech”) efforts to enhance the clearance and settlement of transactions may reopen of long-settled questions about accounting, its role in the development of capitalism, its theological undertones, and its practical efficacy. This essay considers distributed ledger technology, the database systems underlying Bitcoin and similar digital currency experiments. Distributed ledgers do more than record transactions. They can also verify them without apparent human intercession, and they can execute more complicated tasks that take on the appearance of and have some of the same practical effects as contracts. If double-entry bookkeeping animated the modern constitution of subjects and objects of property, what do distributed ledgers herald?

Pages: 82-96

Scientific article

Theory of cultural abjects : societal dealing with unacceptable knowledge

Schetsche, Michael; Biebert, Martina

Abstract:

Our theoretical draft about cultural abjects is conceptually linked to Julia Kristeva’s (1980) psychoanalytic thoughts concerning abjection. This new, now knowledge-sociological category is determined to unravel the culturally invisible and therefore likewise powerful bodies of knowledge. Cutting inextricably across reality regimes these bodies rest outside permanently, repeatedly causing reality crises. Theoretical springboards are the two forms of socially constructed reality’s legitimation by Berger and Luckmann (1966): therapy and nihilation. We argue that there has to be a third, pre-discursive mode of reality regimes’ securitization: Taking a destabilizing effect already by culturally addressing, this mode spurs to action as soon as potential crisis-generating experiences and phenomenons arise beyond a culture’s horizon. After having outlined our theoretical concept we will elucidate some examples of cultural abjects in past and present eventually questioning the methodological terms and conditions for empirical reconstruction of such hitherto even knowledge-sociological invisible bodies of social constructions of reality.

Pages: 97-123

Review

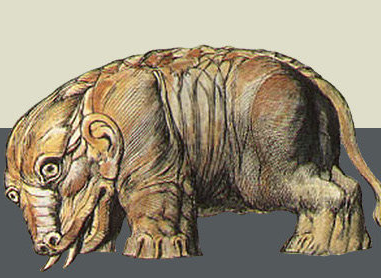

Horst Bredekamp, Der Behemoth. Metamorphosen des Anti-Leviathan / Fach, Wolfgang [Autor:in] – 2016

Fach, Wolfgang

Abstract:

Pages: 124-126